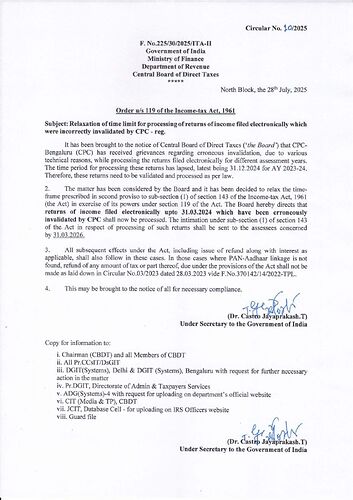

CBDT vide Circular (No 10/2025 dt. 28th July, 2025) provided relaxation in time limit for processing of electronically filed income tax returns declared invalid by CPC. This will provide relief to taxpayers whose returns have been declared invalid by CPC on various technical grounds particularly where signature could not be verified or validated. This is applicable for all erroneously invalid returns upto 31.3.2024 and time for processing has been extended till 31.03.2026. Accordingly, it is advisable that if return filed by Assesses has been declared invalid by CPC and consequently not processed, please immediately follow up for processing of such returns with CPC. Refund will be processed along with assessment with interest for valid PAN.

CS Sharad Bhargava